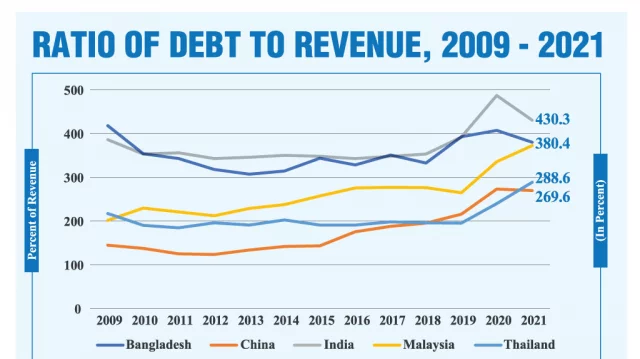

Bangladesh has one of the lowest levels of tax revenue in the world as a percentage of GDP, we always talk about that but it’s also alarming that Bangladesh’s Public Debt to revenue is very high at 380% which is very close to the threshold of 400% for the Highly Indebted Poor Countries (HIPC) under IMF and World Bank definition for HIPC countries, said Ahsan H Mansur, executive director of the Policy Research Institute (PRI).

This poses a risk to the country, both in terms of stabilizing the economy in the short term and maintaining a positive track towards development in the medium term as Bangladesh seeks to become a developed nation by 2041.

Not implementing more widespread reforms will incur a revenue loss worth around Tk50 trillion by FY41, he was speaking at a discussion titled “Bangladesh's Domestic Resource Mobilisation: Imperatives and a Roadmap” organized by PRI on Tuesday.

In his keynote presentation he also said that currently, the country's tax-GDP ratio is 7.6%, which is the lowest in South Asia. It is close to Somalia or the Democratic Republic of Congo. If no reforms are made, this rate will decrease further in the coming years. And it is not possible to reach high-income countries with less than 10% tax-GDP ratio.

The presentation also stated that the need to improve tax revenues is urgent. Bangladesh's economic credibility is currently at risk due to a combination of disturbing trends including declining tax revenue as a percentage of expenditure, a rising debt burden, and challenges to financing the growing fiscal deficit.

Fixing this problem will require increased revenue as reducing spending is not a viable option given increasing pressures from interest payments, rising wage bills, subsidy and pension payments, and growing demand for social spending on health, education and social protection.

IMF support is designed to help Bangladesh destabilize the fiscal situation, but without increasing revenue, Bangladesh's ability to pay its debts will not improve.

In the short term, Tk6000 crore could be raised over three to four years by gradually removing certain tax exemptions. This could be implemented immediately, while other reform measures will take more time to design and implement.

The core medium-term fiscal reforms will include the establishment of a separate tax policy division in the Ministry of Finance, VAT reform, automation of tax administration, the implementation of wealth taxes and reduced dependency on trade taxes.

In the longer term, if the government does not take any reform initiatives and things goes on as it is, by the end of FY 2041 the accumulated potential revenue loss will be around 50 trillion (which is almost equivalent to seven times the current budget size of the government).

Through more wholesale reforms, the government can prevent that loss-leading to a 60% increase on the current tax base.

This would bring Bangladesh in line with peers such as India and Cambodia in terms of tax revenue as a proportion of GDP. This larger size of the government will be needed to maintain Bangladesh's development trajectory as it moves towards LDC graduation, allowing the government to invest in key public services and infrastructure.

However, this revenue effort will have to be carried out while reducing reliance on trade taxes, by rationalizing the tariff structure to boost exports and their diversification.

Increased revenue will also allow Bangladesh's overall economy to grow faster. New economic modelling by PRI-CDRM found that a two percentage points increase in domestic tax revenue levels would result in an additional 0.2 percentage points growth in annual real GDP above current levels.

The model looked at how increasing the revenue collection would impact the economy, assuming the increased revenues are channelled back into public spending in line with current rates of government spending. According to the model, household income and consumption would also increase. All households would experience some benefit, while the bottom 40% of households benefitting the most.

The analysis presented demonstrates that along with a positive impact on growth and stabilizing the economy, higher tax revenues will help Bangladesh to meet rising demands for physical infrastructure, social spending including health, education and social protection, and also help reduce income inequality.

National Board of Revenue (NBR) Chairman Abu Hena Md Rahmatul Muneem in his speech said: “"NBR is working to support business. We are trying to support middle-class items and increase their features and facilities."

About the tax extension culture, he said that not only individuals or big organizations or industries but also government institutions continue to apply for tax exemptions.

The NBR chairman also said: “Everyone enthusiastically says that the tax-GDP ratio in the country is disappointing. But I don't see it that way. It is not right to compare it with that of Somalia or Congo. If you compare with those countries, you have to compare all the parameters.”

He also said that the important thing is to look at the source of revenue of those who have a high tax-GDP ratio. For example, the tax-GDP ratio of Maldives is high. Their main source of revenue is the tourism sector. But we do not have such a source.

The event was attended by State Minister for Finance Waseqa Ayesha Khan.

Regarding the policy bias against non-RMG exports Dr Zaidi Sattar, chairman of PRI said: “Every year, apart from 216 RMG products, we export some 1500 non-RMG products (HS-6 digit), the latter also being sold in the domestic market.

“About 350 of them exceed $1 million in export value, the rest remain below $1 million. Our current tariff-ridden protection structure is creating an incentive bias against non-RMG exports, in favor of sales in the domestic market, where prices are higher than export prices, because of high import tariffs.

“PRI research has revealed that export competitiveness is not the critical problem. We found that, apart from RMG products which are highly competitive, nearly 500 non-RMG products are also highly or moderately competitive in markets where 30-40 other suppliers compete.

“The logical conclusion is that non-RMG exporters are discouraged from exporting as prices and profits are higher in the domestic market. Thus, export diversification suffers as our tariff policy has become a binding constraint to this national priority goal. This anomaly can only be removed by rationalizing the tariff and protection structure, which is the stated goal of the National Tariff Policy 2023.”

Also speaking on the occasion, Dhaka Chamber of Commerce and Industry President Ashraf Ahmed emphasized making tax collection easier through automation and reducing direct contact between taxpayers and tax officials.

He also advocated for giving small industries more time to grow before being taxed.

The event was also attended by Advisor to the Prime Minister on Economic Affairs Mashiur Rahman, Federation of Bangladesh Chambers of Commerce and Industries President Mahbubul Alam, Metropolitan Chamber of Commerce and Industry President Kamran T Rahman, Chattogram Stock Exchange Chairman Asif Ibrahim, former NBR chairman Mohammad Abdul Majid among others.

Policy recommendations by PRI

- Substantially increasing the portion of direct tax revenue in the total income. This alignment would bring Bangladesh in line with other countries of similar income levels.

- Establishing a dedicated tax policy division within the Ministry of Finance, staffed by tax policy experts, distinct from tax administrators. This separation would ensure that necessary tax adjustments for revenue enhancement are made effectively, efficiently, and equitably.

- Overhauling the VAT system to function as a genuine VAT regime, eliminating complexities arising from multiple tax rates on identical products at various production stages. Simplifying this structure would minimize evasion opportunities, thus augmenting revenues. Additionally, it would discourage firm vertical integration, supporting the SME sector through subcontracting by larger enterprises.

- Crafting a feasible long-term blueprint for tax administration reform and automation, thereby enhancing revenue collection.

- Decreasing reliance on import tariffs for revenue generation. This move would discourage import substitution and foster export diversification, crucial for Bangladesh's future development, while bolstering the SME sector.

- Revamping and strengthening capital gains, property, and other wealth taxes' efficacy. This would ensure proper taxation of wealth accumulation while incentivizing the redirection of speculative investment from land to the productive economy, thereby fostering growth.

- Substantially reducing rebates, discounts, exemptions, exclusions, and reduced tax rates applied during taxable income calculations, many of which are subject to abuse. This direct action would bolster revenues.

- Enhancing oversight over the withholding of advance income tax from employee wages and salaries, further bolstering revenue streams.